Here are the Top Payment Gateways in Middle Eastern Countries

Gone are the days when Middle Eastern countries used to be far behind the rest of the world when it comes to technological advancements, that is also applicable to online banking, money transfer, and eCommerce. In fact, most of these countries boast not only the top payment gateways in the Middle East but across the globe. But before we get to them, let’s discuss what a payment gateway is.

What is a Payment Gateway?

To understand what a payment gateway is and how it works, think of a middleman. If you’ve ever had to work with one in your line of profession, you’d already be accustomed to a middleman’s role. If not, they’re the intermediary in a deal, process, or work; in other words: a broker.

Online payment gateways are a digital payment solution to a more common device – POS terminals for in-store card payments. Although, the principal working of both is the same.

Taking from that, payment gateways are third-party companies that authorize transactions between customers and merchants. In other words, they’re a software mechanism that reads the payment data acquired from the customer’s bank. Next, it transfers the data to the merchant’s bank. Upon data validation and availability of funds, the payment gateway then sends the approval to the acquiring bank to move the amount to the merchant’s account. In case of insufficient funds, the payment gateway declines the payment right there.

Surprisingly, all of this happens within seconds, thanks to technology!

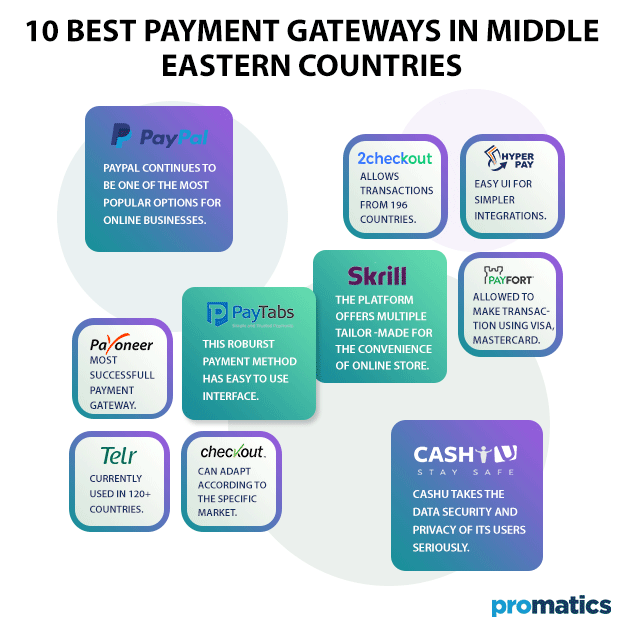

10 Best Payment Gateways in Middle Eastern Countries

To stay ahead in the race of a competitive ecommerce market, you need to level up with each advancement. Considering that customers prioritize their payment details’ security along with convenience like anything, choosing the right payment gateway is fundamental for any business. Otherwise, you can wave goodbye to potential customers. Convinced that your business depends on knowing the best payment gateways in the Middle East? We’ve got you covered.

1. Paypal

Anyone dealing with online transactions could not have missed out on Paypal. One of the pioneers in online payment gateways, Paypal continues to be one of the most popular options for online businesses.

Recent numbers suggest an escalating usage of active users in the Middle Eastern countries, more than one million! With that said, the company does plan to expand its operations but is currently available in Bahrain, Jordan, Kuwait, Oman, Qatar, and UAE.

The benefits of Paypal are endless, to say the least. From signing up only with an email address to receiving payments in 25+ currencies to language selection. Additionally, the platform accepts all the major credit cards, including Visa, Mastercard, Discover, American Express, UnionPay, etc. The company is also well known for its advanced security measures. Let’s not forget it’s fast payment systems, where instant card payments or transfers take only a few minutes.

As far as the fees go, Paypal charges between 1.9 percent to 3.5 percent of the amount, depending on the Paypal product used, in addition to a fixed fee from $0.05-0.45. The currency conversion fee is currently 4.5% of the amount.

2. Telr

Telr, or what you might have previously known as Innovative Payments, has several great digital marketing programs that not only improve your eCommerce business model but also bury your competitors. Telr is currently used in 120+ countries globally, and this fact alone should be enough to account for Telr’s competence and credibility.

But, gladly, Telr has a lot more in store to prove why it deserves to be included in this list. To start with its features, Telr is supported on several eCommerce platforms, the likes of which include Woocommerce, Shopify, OpenCart, Magneto, and Prestashop. As far as available payment options are concerned, customers and clients can use Visa, Master Card, and American Express Cards. Telr also accommodates SADAD, or local Saudi banks, in addition to N.E.T. Banking.

Telr has 3 different options for integration. Either Telr will host the transaction and redirect the customer back to the website after the completion of the payment. Or, it will use an iFrame method by incorporating the checkout site into the website using an iFrame. Lastly, it can incorporate the complete payment form into the website.

Telr is available in several Middle Eastern countries, including UAE and Saudi Arabia. The 3 entry levels of Telr, namely Entry, Small, and Medium, are excellent for SMEs, online businesses, or small startups in the emerging market.

3. PayTabs

Chances are that once you use PayTabs for your online business, you won’t look back. From Saudi Arabia and UAE to Bahrain, Kuwait, and Qatar, PayTabs is gradually expanding its progress in the Middle Eastern countries.

This robust payment gateway is already miles ahead of its competitors in terms of state-of-the-art security layers to protect merchants and customers. If that’s not all, Visa and Mastercard have certified their security management. On top of that, the company has also won several rewards, including “best fintech companies in the Middle East.”

For starters, its easy-to-use interface already adds a +1 to its tabs. Besides that, the platform offers an integration box that allows business owners to customize their stores using plugins. Plus, you can also get payment solutions catered to various industries. They’ve received numerous positive reviews for their responsive customer service, including specialists fully experienced in handling disputes.

PayTabs has recently switched to monthly packages. So if you’re tired of calculating costs for each transaction through a payment gateway, this is your best bet. For transactions up to $2000/month, the company offers a start-up plan for $49.99/month. Businesses with more sales can opt for the growth plan priced at 2.85% and $0.27 per transaction.

4. CashU

Say hello to the first and the biggest online payment solution company in the Middle East AND North Africa! Those operating online stores from UAE, Jordan, Saudi Arabia, Oman, Bahrain, or Qatar would never have to face online payment troubles again when CashU is at your service.

CashU takes the data security and privacy of its users seriously. If you’re not one to fall for statements, their agile fraud prevention systems provide ample proof. They go as far as guaranteed transactions so that their 2.3 million users don’t have to risk everything in another online fraud.

On the bright side, that’s not all there is to the list of benefits CashU offers. The platform comes with the feature of enabling customers to deposit funds in their CashU account and make payments to partnered retailers across the MENA region.

CashU works on an annual pricing system. After the initial setup fee, $1,000, and security deposit, $10,000, you’ll only be charged once every twelve months between $1,000-3,000 depending on your sales. Don’t want to keep the money in your CashU account? Not to worry, the platform allows you to transfer funds to your local account with a minimum transaction fee of 2.9-3.3%.

5. HyperPay

Are you up for the task of leveling with fast-growing businesses in the industry? If that’s the case, HyperPay may be the best decision you make as a MENA-based online store.

Where some online payment gateways have several restrictions on transaction types, HyperPay has made it it’s business to allow merchants to accept all transaction types while managing risk side by side. A bonus point is that their advanced security measures using Artificial Intelligence don’t fall short in any case.

The platform also takes pride in its easy UI for simpler integrations. If you know big e-commerce platform names like WordPress, Oracle, and Magento, HyperPay offers integration with these and more.

Another useful feature most online stores look for, especially those that deal with recurrent clients, is an invoicing feature. HyperPay goes all out to provide that for its business users, too, without having to switch tabs.

The merchant charges vary from country to country. To find out more about their merchant charges, email them at bd@hyperpay.com.

6. Skrill

To say that Skrill has taken over the world by storm would be an understatement. Originally known as the MoneyBrooker, the company has managed to become a leading payment gateway in 200 countries across the globe, including UAE, Saudi Arabia, Bahrain, Qatar, Kuwait, Oman, and Jordan.

The platform offers multiple features tailor-made for the convenience of online stores. From quick transfers and seamless integration to a singular multi-currency account and advanced analytics, Skrill hasn’t left a single blank spot.

This payment gateway is definitely giving its leading competitors a run for their money, especially considering its low fees. If the no start-up fee wasn’t the cherry on top, the company only charges 0.9% on accepting payments from card transactions and 0.5% on rapid transfers. Their customer service is available 24/7 through phone, email, and live chat should you have any queries or issues. To top it all off, the company is FCA-regulated and PCI-compliant, meaning that all transactions are 100% protected at all times.

7. 2CheckOut

Numbers are one way to describe 2CheckOut. It is the only online payment gateway that allows online transactions from 196 countries, has 8 payment channels, uses 26 currencies, and operates in 15 different languages. The company went all out to lay a solid foundation, scale it up, and present it not only to a few selected countries but to the entire globe.

2CheckOut boasts several features that make the company a notch above its competitors. For starters, it is supported by all the eCommerce platforms that are available, with the exception of only a few. Moreover, the company does not require any setup charges or monthly maintenance fees.

The company allows Visa, MasterCard, Bank Transfer, American Express, PayPal, and Apple Pay. It either uses the API integration method with PCI DSS compliance or the iFrame method.

You can use 2CheckOut in a number of countries, including UAE, Saudi Arabia, Bahrain, Kuwait, Oman, Jordan, and Qatar.

8. Checkout

When it comes to renowned payment gateways, nothing is more popular at seamless transactions than Checkout. The company’s goal is to allow its clients’ businesses to be moved rapidly, and for that, it offers a variety of scalable and customizable solutions.

The company boasts several unique features that help it rank among the best payment gateways in Middle Eastern countries. Checkout’s app can adapt according to the specific market. As a result, customers and clients can enjoy an exceptional experience.

Checkout’s supported eCommerce platforms include Woocommerce, Magneto, Prestashop, and Shopify. The setup is simple and free, which makes it excellent for young entrepreneurs living in the UAE.

9. PayFort

PayFort is Amazon’s payment processing company that can be the payment gateway that you want and need, whether you are planning on accepting payments, growing your company, or looking for industry insights to help you make better, data-driven decisions.

The company supports many eCommerce platforms, including Woocommerce, Shopify, Magneto, C-S Cart, OpenCart, and Prestashop. While using PayFort, you will be allowed to make transactions and payments using Apple Pay, Visa, and MasterCard. As far as PayFort’s integration is concerned, the company uses One API-API integration in addition to plugins. You can choose from either of the two checkout methods, including the Merchant Page or the Tokenization.

The platform is tailored exclusively to the trends in the Middle Eastern countries, which is why it has excelled in Saudi Arabia, UAE, Lebanon, Oman, Qatar, Kuwait, and Jordan.

10. Payoneer

People who took up freelancing during the lockdown or earlier know a lot about Upwork and Fiverr. Well, the money you earn from these websites comes to your Payoneer account and then to your personal bank account. So, Payoneer is one of the most successful payment gateway services, not only in the Middle East but across the globe, for digital payment and international or domestic money transfers.

Payoneer has several advantages over other payment gateways. Firstly, all transfers made between Payoneer account holders are free. Additionally, the company offers a decent exchange rate which is better than what most of the competitors offer. Moreover, the sign-up process is not that hectic and can be done quite easily.

For these reasons, many citizens of Middle Eastern countries like Saudi Arabia, UAE, Qatar, Lebanon, and Jordan consider Payoneer as the best payment gateway in the Middle East.

Take-Home Message

A few years back middle eastern countries realized that websites and apps are the new oil and have accelerated digital adoption. Now that you have the best payment gateways in the Middle East at your fingertips, it’s time to hop on the seamless transactions bandwagon. Whether you were in search of one for your newly launched ecommerce store or you’re thinking of switching from your previous payment gateway, the ones listed above won’t disappoint you. Make sure to select a payment gateway best suited for your requirements from the checklist above, and you’re good to go!

Still have your concerns?

Your concerns are legit, and we know how to deal with them. Hook us up for a discussion, no strings attached, and we will show how we can add value to your operations!