What Does It Take to Build a Loan Disbursal App?

Financial technology, also known as fintech, is an emerging industry segment that has begun to really disrupt traditional delivery methods of financial services. With it, financial activities that were extremely cumbersome at one point in time have become extremely simple and agile.

All thanks to the new generation cloud-based mobile apps, purchasing insurance, applying for loans or investing in the financial markets has become a matter of a few taps on a smartphone. When talking about the ease lent by different types of fintech applications, the most popular financial services on offer via mobile apps include the loan-based products that help the masses avail credit quickly and easily.

Individuals can simply download an app, verify their identities and apply for a loan. If the verification process is successful, their loans get sanctioned immediately. Thousands of customers have benefited from these types of instant loans by using apps like Branch and Tala, which offer these types of functionalities.

Why do people prefer mobile applications to get their loans sanctioned?

Historically, there has always been a hesitation and a stigma of sorts attached to seeking loans. The traditional banks often require loan seekers to fill up several lengthy forms and answer intrusive questions posed by the banking officials – only to be told that their loan application is rejected. In addition, in many societies, seeking loans has a significant degree of societal stigma associated with it, which makes many people reluctant to apply for them to avoid being judged.

App-based loan services such as Branch and Tala step in to fill the gap, infuse ease in the process flow along with offering the mental comfort of accessing simplified credit options. These apps offer instant loan originations, right from the comfort of one’s home. In just a few taps on the smartphone or tablet, one can get a loan for whatever purpose, with no kinds of judgments, whatsoever. After all, technology doesn’t judge.

These apps based simplified lending models typically come under the Peer-to-Peer (P2P) loan market, which is set to grow in the coming years significantly. By 2022, the total value of transactions in the P2P lending industry is estimated to be a staggering $292 billion.

While China, the US and the UK are expected to be the largest markets, countries in Asia and Africa are not far behind. In fact, Branch and Tala are revolutionizing mobile app-based lending across the developing world in Africa and Asia. In these regions, the demand for loans is huge but the accessibility part is very restricted. Mobile loans through these apps fill up the crucial gap, while also addressing the issue of loan stigma by way of near-anonymous loan sanctions.

Examples of lending applications: Branch and Tala

Branch is currently operational in Mexico, India, Nigeria, Tanzania and Kenya. Currently, it is only available for Android users. In order to avail a loan quickly, all one needs to do is go to the Google Play Store and download the Branch app. The next step is to submit personally identifiable information and ID proofs such as social security number, Aadhaar card and the bank account number. ID card requirements typically vary by country and the applicants need to confirm which documents will be acceptable in their country of residence. Once the application is submitted, Branch makes a disbursement decision within 24 hours of receiving it. On average, it takes just about 8 hours to process a loan.

Tala offers loans in Tanzania, Kenya, Philippines, Mexico and India. This application too is currently available only on Android devices. In addition to loans, Tala also provides instant credit scoring facility and other personalized financial services in the countries where it is operational. Loan disbursement decisions by Tala are made based on a number of criteria such as income, location of residence, repayment of past loans and credit scores. If a user’s loan application is rejected, he/she is advised to keep the app installed and surely try again later. The app stores and uses data that the user shares in order to build a personal credit profile.

How do such P2P lending applications work?

The formula for P2P lending applications to disburse loans quickly is sample. The funds are crowd sourced, which eliminates third parties and brings loan products to the user directly. Loans are sanctioned based on the data shared by the user and also insights drawn from algorithms that take various online and offline datasets into account. Some lending applications additionally require access to phone data as well. Repayments on these loans are assured as they are tied to credit scores and customers are motivated to keep their credit scores high.

At this point, it is safe to assert that fintech applications have totally disrupted the role of traditional lending authorities such as banks due to the rapid adoption of digital technology. While the architecture of these applications vary, they can be customized minutely and built for both iOS and Android devices. Excellent user interface and self-service banking features are usually the hallmarks of these applications, which have made them very popular.

What are the common features of mobile-based loan apps?

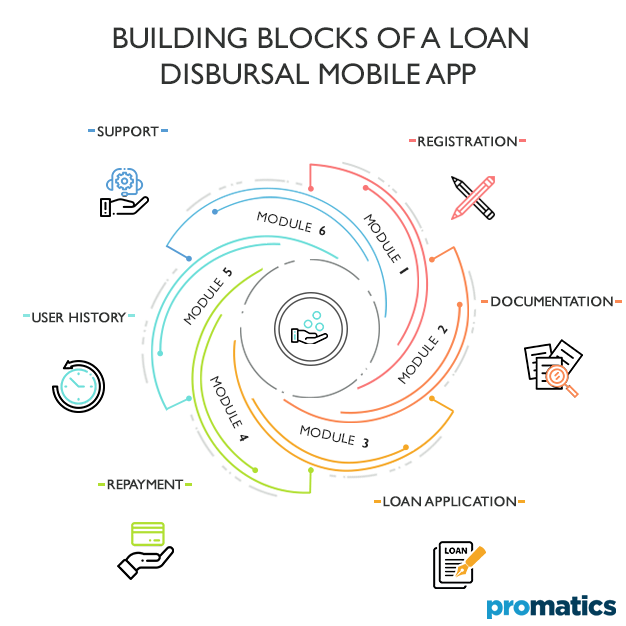

As such, fintech lending platforms have some essential features that are universal to almost all apps.

These include the option to:

a.) Register and upload documents: Sign up for an account and verify one’s credentials by uploading ID proofs and other documents

b.) Apply for loan: Make a loan application by filling out a form right within the application

c.) Repay loan: Easily make loan payments right from the application by connecting it with another banking service or a card

d.) Contact customer support: Speak to customer support in case of any kind of queries or complaints

e.) Attractive UX/UI: Loan amount, interest and balance amount are all neatly displayed graphically.

If you’re planning to explore the territory of developing fintech loan disbursement applications, there exists room to add value, and differentiate your new offering from the existing pool. The next section talks about the technology features one may capitalize on.

What features can the lending applications better?

Applications such as Branch and Tala have been thriving hard to win customers and the outcomes demonstrate that they have already carved out a niche for themselves. The good part is that their existence and acceptance validates the business model. The better part is that there are several windows of opportunities still remaining to capitalize on, if you wish to launch a similar, improved loan application.

Some features that can improve the user experience and utility of loan-based fintech app entrepreneur and help its owners gain competitive advantage include:

Artificial intelligence: There are many opportunities for you to integrate artificial intelligence to make your loan application smarter and more intuitive. The first step is to consider using AI for making the process of loan sanctioning more accurate. The next step is to use natural language processing to understand the customers and their needs better. The third step is to leverage artificial intelligence for providing improved and automated support in the form of chat bots and virtual assistants.

Blockchain: Integrating blockchain is also a very promising move. Smart contracts can help to verify the identity and integrity of loan applicants much more quickly and accurately. Distributed ledgers are already being used by financial institutions to verify identities and to process forms. Smart contracts can be used to automatically sanction loans when the users meet the criteria set by your own pre-defined algorithms.

Conclusion

There is a wealth of exciting and practical opportunities in the fintech space for those who are looking to build and launch mobile applications. In particular, lending services are in great demand across the world, and the P2P lending, as a segment, is expected to grow exponentially.

If you wish to leverage the trend and launch applications similar to popular ones like Branch or Tala, you can choose to take your apps to the next level by implementing blockchain and artificial intelligence. In addition, you can focus on customer self service and excellent customer support, so that users can lend and repay without any middlemen or roving eyes.

Still have your concerns?

Your concerns are legit, and we know how to deal with them. Hook us up for a discussion, no strings attached, and we will show how we can add value to your operations!