An Insight into How Mobile Apps Are Leading Digital Transformation in Africa

The continent Africa has been home to some of the world’s fastest-growing economies with GDP well above the global average, in the recent past and figures state that 2020 would not be any different. Countries like South Sudan (8.2%), Rwanda (8.1%) Côte d’Ivoire (7.3%), Ethiopia (7.2%), Senegal (6.8%), Benin (6.7%) and Uganda (6.2%) along with Kenya, Mozambique, Niger and Burkina Faso all expecting 6% growth are all set to be the crown jewels in the crown of the African continent. A $16 billion opportunity stands to knock at the door of Africa with African Continental Free Tree Agreement (AfCFTA). Thanks to the 100% liberalization of tariffs under AfCFTA, it is estimated that the aggregate GDP of the participant African countries would jump to $3 trillion by 2030.

What’s more is that a tech revolution is making its way slowly, yet steadily to even the most isolated regions of Africa, mostly through cost-effective cell phones tech. There was a phenomenal increase from a modest 2.1 per cent in 2005 to 24.4 per cent in 2018, in the number of people using the Internet in Africa, according to ITU data. The late horizon of the digital economy promises a significant competitive advantage to African nations. They benefit from the established advanced and widespread mistakes already prevalent in the developed world. Masses are well receiving the recent tech influx as more and more people choose to buy necessities and other commodities through digital mediums. Estimates suggest that the future growth opportunities in Africa will increasingly be concentrated in rural and low-ARPU (average revenue per user) markets, as well as younger demographic groups. Some modern African startups are using the latest tech to cater to the indigenous needs of the population.

Initiatives like Transform Africa Summit, powered by the Smart Africa Alliance aim at accelerating sustainable socio-economic development through affordable access to Broadband Internet and the use of information and communication technologies. More and more businesses realize the enormous potential for leveraging technology in the continent for driving economic growth and development as well as accelerating progress towards sustainable development goals.

The Digital Economy That Would Be: Africa

In a quest to catch up with the rest of the retail world, globally-aware African consumers gear up to see brands cater to them in ways unimagined previously. As local companies come forward to utilize online and offline channels, Africa is set to educate the rest of the world about digital experiences.

Keeping in mind shopper expectations, here are some tactical opportunities that businesses can tap into, to fuel their growth in Africa.

Modern Marketplaces

While Africa on the whole accounts for just 2% of online purchases globally, the e-commerce phase is only just starting to take over the continent. The delay in the adoption of e-commerce solutions can be blamed to the fact that many African consumers don’t see any immediate need to convert to a more digitized mode of shopping

In Africa, online stores owned by a single brand are unlikely to be as popular as online clusters offering multiple brands in a single platform. Sellers need to think digitally, to provide a variety of entities that can be accessed on one branded platform. Since bartering, communal transactions, active price comparisons and even socializing are a big part of African shopping culture, a modern marketplace will cater to the market sentiments in suitable ways. Majorly, women are accountable for purchasing groceries and household goods. A paradigm shift in working dynamics like longer working hours, they have less time to go to the marketplace and are embracing online shopping. These shoppers expect online retail apps that mimic their shopping experiences offline.

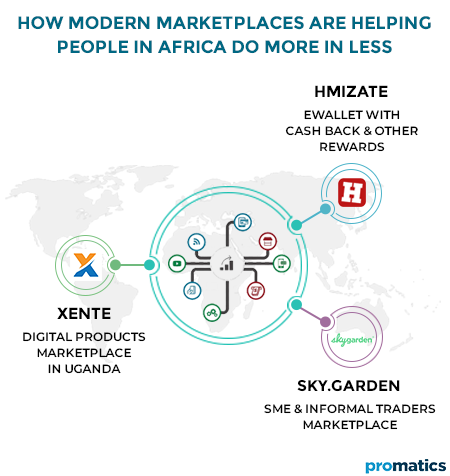

A few pioneers:

| Sky.garden An e-commerce platform of African origin, sky.garden provides fruitful opportunities for small businesses and informal traders to sell their products online. Sky.Garden has hosted over 3,000 registered sellers with over 23,000 products on sale, since its launch in 2017.

Xente A platform for Ugandan merchants – Xente is an online marketplace featuring over 50 Ugandan merchants who sell digital products such as cell phone credit and TV subscriptions. It allows global shoppers to shop, pay bills, buy tickets and search for discounts with great ease. Xente will enable users to make payments through credit card, mobile money or bitcoin and even pay later in instalments. Xente plans to expand operations to include Ugandan merchants who sell physical products Hmizate Launched in 2018, hmizate is a Morocco-based e-commerce fintech platform. Their product HmizatePay is a mobile commerce and payment platform. It allows users to create an e-wallet which can be used to pay for purchases and receive cash back and rewards. It is a one-stop-shop for online payment needs.

|

Businesses trying to build new market places for African consumers should keep in mind the essential benefits of e-commerce like convenience, accountability, security and more. Building mobile apps for modern marketplaces is an excellent choice. If you are a business having a product or service, opt for a current market place that fits your brand and helps it gain some visibility through flash sales or targeted advertising.

Logistics solutions

Africa’s struggle due to lack of adequate infrastructure is renowned. It strains the day to day life of consumers. With new-age development and growth, the expectations about the level and quality of service delivery in Africa is rising, however. All foresighted brands understand this shift and thus, more and more players are making logistics quandary an absolute priority.

Since a large chunk of Africa’s working-age population is starting new businesses, there is a surge of new ideas, services and solutions that promise improved delivery standards.

| Who’s leading the charge:

Mobar An app that delivers alcohol in less than one hour, it connects customers with distributors in Kenya. Mobar allows customers to order from local businesses, with guaranteed courier delivery within one hour. Zulzi Zulzi is a delivery service that supplied textbooks and gadgets to students within one hour, but it expanded to include groceries, pharmacy items and alcohol too. It partners with shops on a commission basis as well as packaging companies who offer discounts and advertise via the platform.

Based in Kenya, sokowatch is a mobile delivery network that keeps small businesses stocked. It is a B2B app that allows small stores to place orders via SMS and receive products from more giant multinationals within 24 hours.

|

If you are a business thinking of utilizing cellphones to mobilize citizens operating in the African economy, you need to think about how your brand can employ and organize networks and maybe with mobile apps. Convenience can be the driving factor here. A delivery solution with streamlined moments of exchange is everything that African appreciates. Since mobile money is growing in Africa, ensure that your app makes the transaction process, from payment to communications easy. If you are a business already collaborating with an efficient delivery brand, use the freed-up time to provide an even better after-sales service.

Indigenous Brands

Afrofuturism and Africa Rising are the buzzwords in the continent and rightly so. The political and socio-cultural influence of Wakanda Africa is all set to rise globally. All kinds of African products, ingredients, symbols, lifestyles and traditions are increasingly becoming modernized to serve the cultural needs of domestic consumers better. Several African countries are banning or placing high tariffs on imports from around the globe. Rwanda and Nigeria have banned certain imported items from forcing their local consumers to look for local alternatives. The uprising of the middle class seeks to preserve traditions and maintain heritage. While the aspirational consumers would want to own different products once they’re financially capable of doing so, Western brands are hardly the obvious choice.

| For example:Palace travel

A US-based travel agency Palace Travel hosts tours in African locations that enable people to take part in several cultural activities. Talata An Interior design startup brand with an Egyptian aesthetic, Talata, offers home furnishings and interior design services along with products made by hand in Egypt. They also partner with up-and-coming designers, in Egypt and other countries across the Middle East. Ozidu House A Nigeria-based startup, Ozidu House hosts exhibition to bring forth the richness of the region’s colonial era. It offers the vivid opportunity to purchase hand-made jewellery, rugs, baskets and homewares from luxury ethnic accessories retailer Ozoza Lifestyle and conducts talks about colonization and its impact on Nigeria and Nigerian art. Mobius motors A Nairobi-based brand Mobius Motors offers vehicles designed to handle the unpaved roads that predominate in Africa. They are produced in Kenya, with a ‘no-frills’ aesthetic. |

West is no longer the best for Africa. Businesses need to update their strategy and tinker with demographic segments to offer the very best. The bulk of new African consumers are moving towards the more relevant and more practical: homegrown. It’s essential to embed quintessentially African culture, aesthetics and narratives into what you have to offer.

How App Proliferation Will Transform Africa into a Digital Economy?

Affordable cellphone prices are one of the chief factors driving the digital revolution in Africa. According to the data, the number of SIM connections in Africa will rise to nearly 1 billion at the end of 2020. Smartphones allow easy access to the internet for Africans.

Mobile phone operators and mobile app development companies are intelligently leveraging the power of mobile networks to transform the way sectors like health, agriculture, education, energy and water management function. Figures indicate that the number of mobile internet subscribers in Sub-Saharan Africa has quadrupled since the start of the decade and the upsurge has just begun. For a large chunk of the African population, mobile channels are the only way to get online. What’s noteworthy is that new networks and cheaper smartphones are helping drive the transition to mobile broadband in Africa. The high cost of expanding service provision requires stakeholders to collaborate in the most cost-effective manner possible. Pre-requisites of such collaborations as infrastructure sharing, are already in place. Cost-efficient data and subscription pack will further push the trend in the continent.

Mobile apps are indeed poised for explosive growth in some key African countries in 2020. Mobile operator and startup initiatives, along with the rise of tech hubs, are collectively playing a role in turning prospects into a reality. The steep growth in smartphone use is driving companies to develop new products to boost engagement with their user base. We believe government policies can drive digital inclusion and grow the digital economy in the process.

A significant trend where mobile-enabled platforms increasingly disrupt traditional value chains in different verticals across the region is evident in the continent. These platforms are mostly developed by a rapidly expanding local tech startup ecosystem which aims to eliminate inefficiencies in conventional business models. Their objective is to extend the outreach of services and provide more excellent choice to customers. We believe that skinnier versions of apps that thrive on minimal usage of data are the need of the hour for businesses which aspire to succeed in the African continent. App versions like Facebook Lite, Facebook Messenger Lite, Twitter Lite, Google Go and others are not only quicker to access but also cheaper to use than their full-data equivalents. The time is ripe for app products that offer cost-effective access to goods and services to meet the needs of the Africans.