Case Study

Fezaga - A Unified Social Trading & Wealth

Allocation Platform

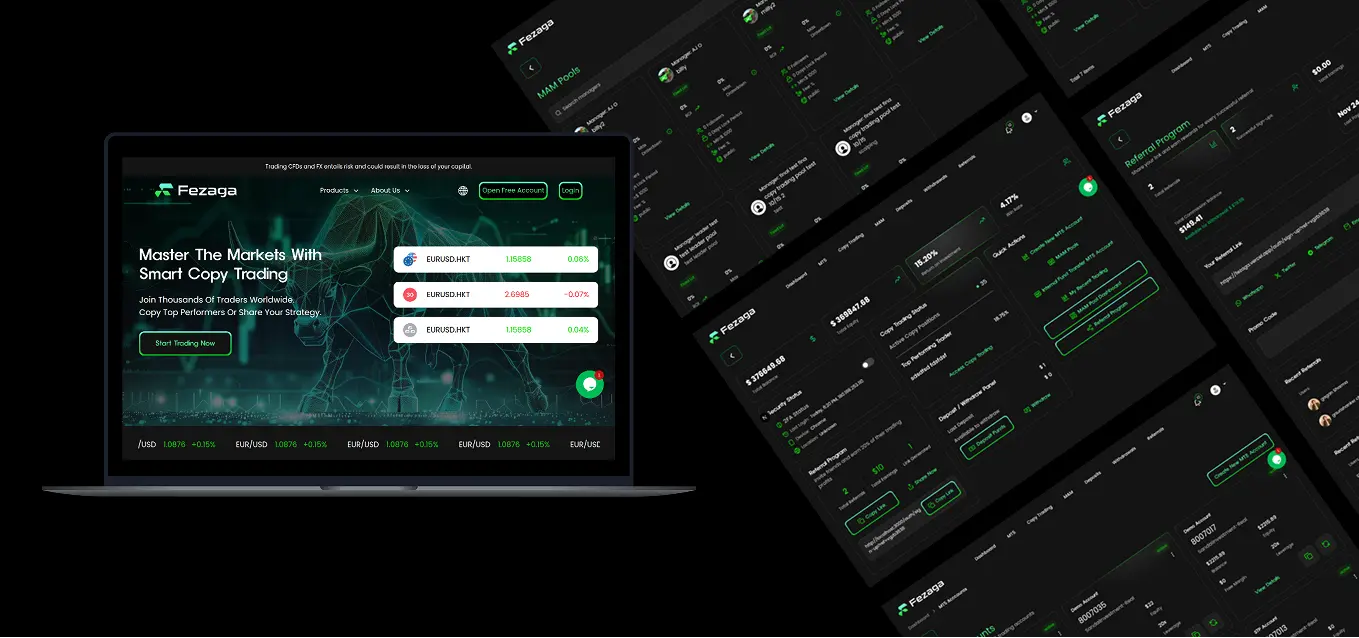

Fezaga set out to build something unusually ambitious—a single platform where everyday investors, experienced money managers, and licensed brokers could work together without the complexity people normally associate with forex and commodities trading. Instead of giving users dashboards full of charts and jargon, the idea was to simplify everything behind a transparent performance-based model.

When Fezaga approached Promatics, they wanted three systems—PAMM, MAM, and Copy Trading—to work side by side, but without the fragmentation usually found across different brokers. Each system had its own rules, maths, fees, and allocation logic. The challenge was to stitch them together so cleanly that a normal investor could choose a trader, allocate funds, and let the system do the rest.

Promatics worked closely with the Fezaga and brokerage teams to craft the allocation engine, profit-sharing rules, and user experience. The final product became a platform where users can follow expert traders, managers can handle multiple investor accounts responsibly, and brokers get a transparent structure that aligns risk and reward.

The Challenge

The moment we started analyzing the requirements, it became clear this project wasn’t just about building a dashboard. PAMM and MAM systems follow strict financial rules. Copy trading adds a completely different level of flexibility. Brokers have their own constraints—minimum lot sizes, step sizes, leverage settings—that must be honored for every trade copied to investor accounts.

But the real challenge wasn’t mathematical. It was fairness.

Performance fees had to follow high-water mark logic. Investors must never be charged twice for the same recovery period. Allocation had to remain balanced, even if capital changed mid-cycle. And everything had to run in sync with MT4/MT5 trading servers so that every investor receives the correct reflection of a master trade.

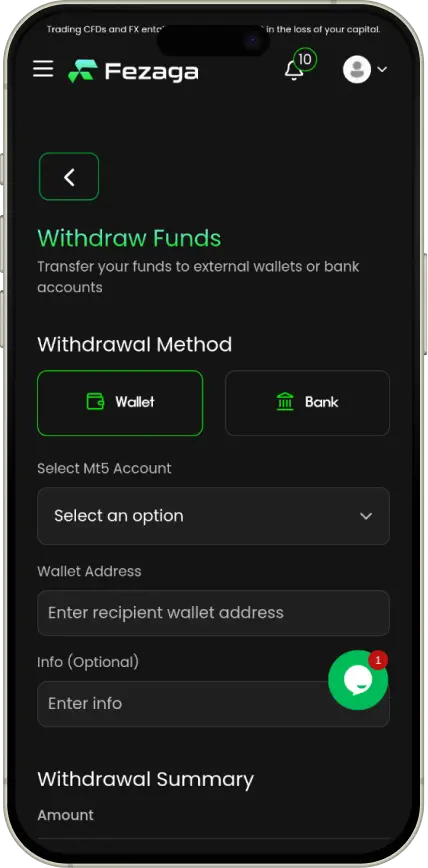

Another layer of difficulty came from user psychology. Investors want clarity. Managers want control. Brokers want transparency. Fezaga needed to satisfy all three without overwhelming the interface or exposing users to unnecessary complexities.

Promatics had to interpret the financial rules, translate them into technical logic, and then build a system that remained accurate even under heavy trading conditions.

- Unified platform for PAMM, MAM, and Copy Trading

- Fair profit-sharing based on performance

- Allocation proportional to investor equity

- Broker-compatible execution

- Clear UX for investors & traders

- Full transparency for brokers

- Flexible follower-based trading

Client’s Expectations

- Modular allocation engine supporting all three systems

- High-Water Mark methodology with automated settlement

- Auto Risk Balance (ARB) engine with real-time recalculation

- MT4/MT5 Manager API integration with trade validation

- Clean dashboards, performance charts, allocation insights

- Detailed audit logs, allocation trails, fee reports

- Copy trading with adjustable multipliers and manual overrides

Promatics’ Deliverables

Prominent Features

PAMM – Percent Allocation Management Module

PAMM is where investors pool capital under a skilled trader, and trades are executed proportionally for everyone. Promatics built a performance engine that applies the Auto Risk Balance (ARB) rule—meaning every investor risks the same percentage of their equity as the master. The system recalculates lots in real time as equity changes. At the end of a cycle, profit sharing follows the High-Water Mark principle so no investor is charged twice for the same recovery.

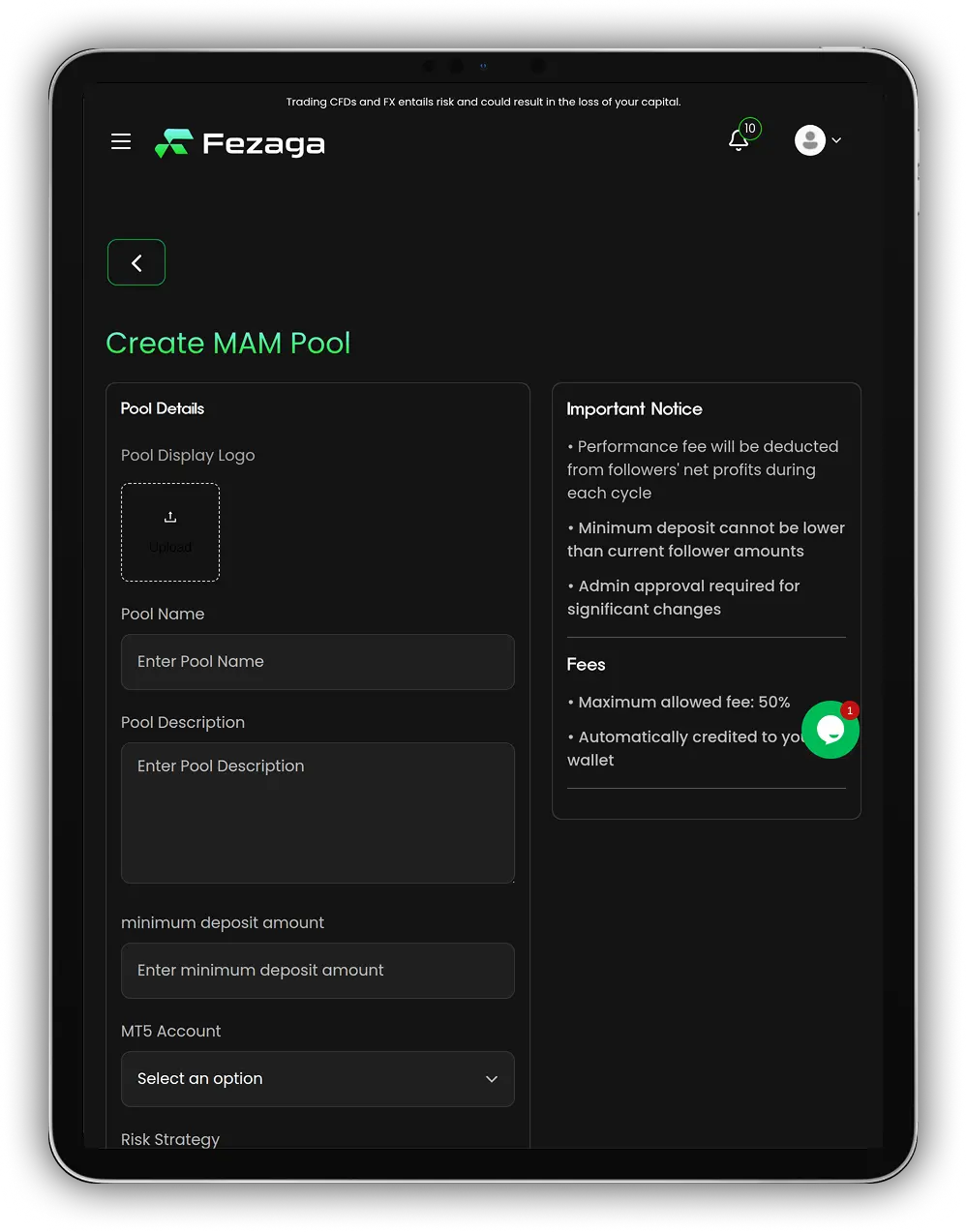

MAM – Multi-Account Manager

MAM is built for licensed managers handling several clients at once. Unlike PAMM, MAM does not allow multipliers or custom risk modifications—everything is strictly equity-proportional to protect investors. A manager opens a trade once; all connected accounts follow instantly. Promatics developed a reconciliation layer that adjusts allocations if deposits or withdrawals occur mid-cycle, ensuring the manager’s risk settings are honored.

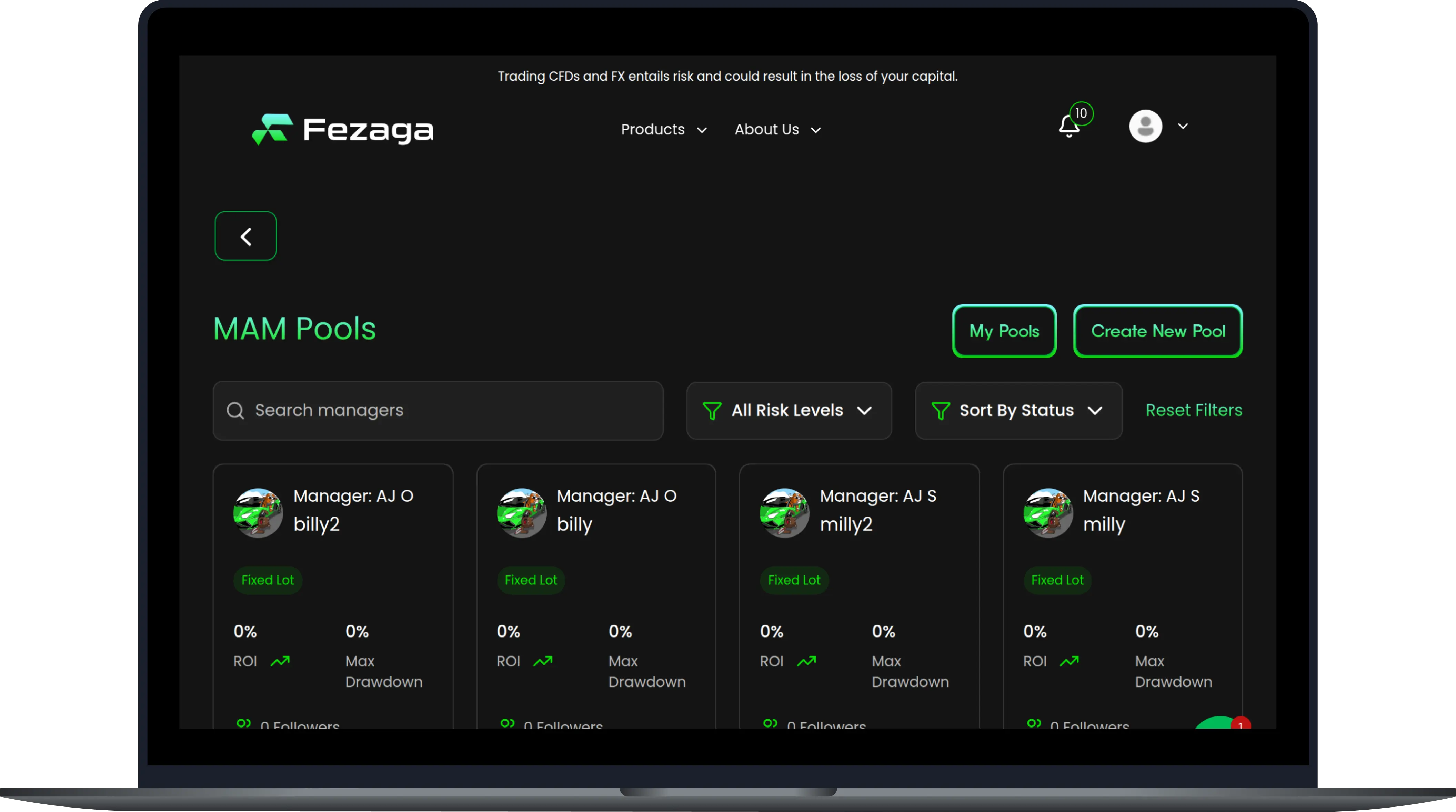

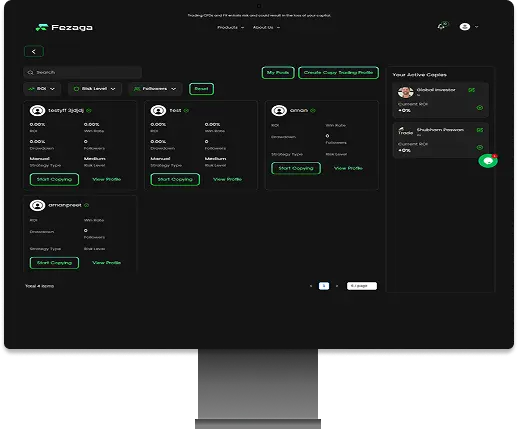

Copy Trading

Copy trading is more flexible. Users choose a trader, apply a multiplier (0.5x, 1x, 2x), and decide how aggressively they want to follow. The follower can close a trade manually even if the master keeps it open. Promatics built a real-time sync engine that listens to every master trade and issues corresponding instructions to follower accounts, while respecting broker rules. Performance pages show ROI, drawdown, risk level, and historical patterns in a form simple enough for casual users.

Allocation Engine – Auto Risk Balance

At the core of all three systems is Fezaga’s ARB engine. It calculates allocation using current equity, not balance, which aligns real risk between users and managers. The formula is simple, but the reliability needed to execute it under live market conditions required a carefully engineered backend.

High-Water Mark Fee Logic

Promatics implemented the High-Water Mark model so managers earn fees only when they achieve new profits above previous peaks. This protects investors and creates trust—something that is often missing in retail trading environments.

MT4/MT5 Integration

The platform connects directly with broker trading servers via the Manager API. Every trade is validated, logged, allocated, and reconciled. This layer ensures the system remains in sync even during periods of high volatility.

Performance Dashboards

Both investors and managers get dashboards showing equity curves, ROI, floating P/L, drawdowns and past cycles. The goal was clarity—users shouldn’t need a trading background to understand their results.

Settlement & Fee Distribution

Profit cycles close weekly or monthly. Fees are calculated automatically, deducted before withdrawal, and distributed to managers through the internal settlement layer.

Outcome

Fezaga became a single place where investors, professional managers, and brokers can operate transparently. Investors get the simplicity of following skilled traders without manual execution. Managers get a structured system with fair compensation. Brokers get logs, audit trails, and a risk-aligned allocation model.

Promatics’ work on the allocation engine, performance logic, and MT4/MT5 integration ensured the platform behaves reliably under live trading conditions. Fezaga can now scale across brokers, add new asset classes, or even plug in different trading engines without redesigning the system.

- Unified PAMM + MAM + Copy Trading architecture

- Auto Risk Balance engine

- High-Water Mark fee structure

- MT4/MT5 integration

- Multi-tenant dashboards

- Automated settlements

- Allocation logs & transparency tools

- Unified PAMM + MAM + Copy Trading architecture

Promatics’ Contribution

- Users operate all models under one ecosystem

- Risk remains fair across all investor accounts

- Protects investors and builds trust

- Immediate and accurate trade replication

- Clear visibility for investors, managers, brokers

- Removes manual errors and accelerates fee distribution

- Strengthens compliance and broker trust

- Users operate all models under one ecosystem

Impact

Software &

Technologies Used

Languages we have used to create web user friendly across multiple devices without compromising the speed.

Microservices

Designing independent services, scaling without limits

React.js

The backbone of the web, shaping digital landscapes with structure and semantics

Node.js

Crafting visual magic, shaping digital beauty effortlessly

Express.js

Empowering seamless navigation and location-based experiences with precision and innovation

PostgreSQL

Powering data integrity, scaling performance effortlessly

Redis

Powering real-time experiences with ultra-fast data retrieval and caching

Firebase Cloud Messaging

Streamlining web development with elegant design and responsive layouts

JWT Authentication

Securing access with stateless tokens and seamless authentication.

OAuth 2.0

Enabling secure authorization, scaling access effortlessly

SendGrid

Delivering reliable emails, keeping users informed effortlessly

AWS S3

Storing data securely, accessible anytime, effortlessly

HTTPS/SSL

Securing data in transit with encrypted connections effortlessly

Secure API Gateway

Safeguarding API connections with end-to-end encryption

Role-Based Access Control

Controlling system access with precise role-based permissions

MT4/MT5 Manager API

Integrating trading systems with seamless API access

WebSocket Stream

Delivering live trade updates in real time effortlessly

FIX Bridge

Connecting brokers securely via standardized FIX protocol

Testimonials

Promatics helped us bring structure and fairness into a complex trading environment. The allocation engine works smoothly, the dashboards feel intuitive, and the system has made it easier for both investors and managers to operate confidently.