Apple Card starts rolling out: All you need to know

Apple card is a credit card that is linked to Apple Pay platform. As Apple makes a grand entry into the credit card business with Apple card and we bring to you all exclusive insights that you need to know.

Appearance

The gorgeous credit card is made up of titanium entirely. It features laser etched inscription of the card holder’s name. There are no traces of any card number or an expiration date on the front of the card as in traditional credit cards. You won’t even find any CVV or signature on its back. So, there is no way any unauthorized individual can use the card for digital purchases. You can find your card number and CVV on the wallet app. The titanium Apple Card weighs 14.7 grams. All you would be able to see would be a traditional magstripe on the back, along with a built-in chip.

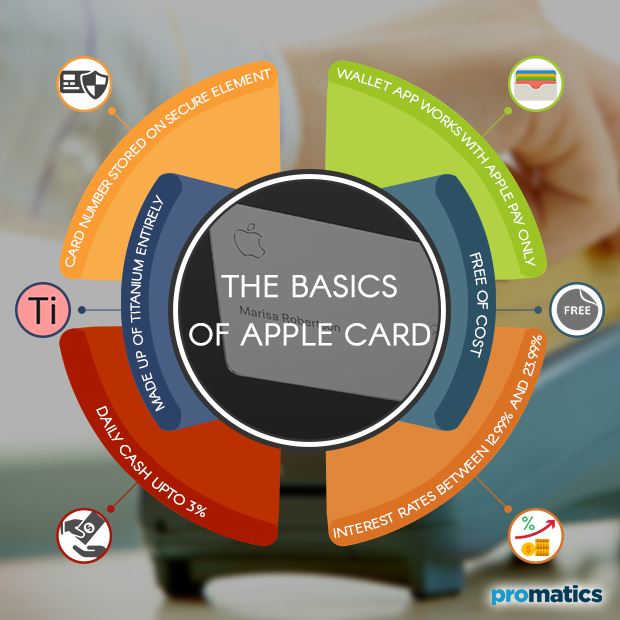

Basics

Apple Card is housed in the Wallet App. It is a private and secure solution for iPhone users and incurs no extra fees and low interest rates. Apple card works as any other normal credit card. Apple is currently collaborating with Goldman Sachs and MasterCard for the same. The physical Apple Card has no support for contactless payments. A user would have to use their iPhone for Apple Pay payments. The company provides the card at no cost neither is there any fee associated with replacing it if you lose it. The card also provides cash rewards.

Availability

As a part of its “preview rollout” in the US in early August, Apple made the card available to only a few privileged customers. However, as of 20 August 2019, it was made available to all qualified users in the US. Availability of the Apple Card in other countries is yet to be announced.

Eligibility

For a US resident to get an Apple Card:

a.) The individual needs to be 18 years or older

b.) The individual needs to be a U.S. citizen or a lawful U.S. resident with a U.S. residential address (no P.O. Box)

How to Get the Apple Card?

Only iPhone users can be users of an Apple Card. Users need to turn on the two-factor authentication and must sign in to iCloud on their iPhone with their Apple ID. Apple card can be accessed by users who are using iOS 12.4, the updated version of the iPhone. However, card availability is a matter of credit approval as in the case of all other credit cards. Apple Cards come with a certain credit limit that varies from person to person. A user with a better credit score can achieve a higher credit limit. Approvals to the credit check are given by Goldman Sachs using TransUnion. For users who have a credit freeze applied, they will need to unfreeze their TransUnion credit. TransUnion gives users the option of temporarily releasing their credit report for a set number of days, which makes it simpler to unfreeze and then refreeze your credit. Additionally, lifting your credit freeze temporarily is free. Apple performs a soft credit pull when a user applies for Apple card. The user can therefore see Apple’s offer with credit limit and APR. A hard pull is conducted after the user hits the “accept” button.

Download the Wallet App on your iPhone.

1.) Tap the ‘+’ button to start the app.

2.) To register for the card, fill in details like date of birth, address, income and social security number. A chunk of information is integrated from your Apple ID and thus the onboarding becomes really quick and simple.

3.) Upon signing up, Apple Card is instantly available for use to its customers for digital purchases. The physical card is shipped to a customer by Apple soon after.

If you are an iPhone user who is on the developer build or public beta of iOS 13, there will be a need for you go downgrade back to iOS 12.4 to used the Apple Card.

How to Activate the Apple Card?

When you receive your physical Apple card in the mail, you can activate it quickly. If you use an iPhone XS, XS Max, and XR, just hold your iPhone near the card envelope for an NFC scan. You can then tap the “Activate” button on your iPhone as it pops up. If you use an iPhone X and any other earlier version, you can open up the Apple Card. Then open the Wallet app and tap on the “Activate” button. Proceed to hold your iPhone device near the packaging in which the Apple Card came.

Use the Apple Card with or without Apple Pay?

Apple Card is so designed that it works well with all other credit and debit cards that are compatible with Apple Pay and are stored in the Wallet app. The Apple card can easily be stored as your default credit card and can be used to make purchases from Apple devices like Apple Watch, iPhone, iPad, and Mac.

For customers who intend to make purchases outside of the Apple Pay ecosystem, a physical version of the Apple Card does the trick. The physical Apple card would work at all the location where Master Card works.

Interest Rates

The company has set the Apple Card APR between 12.99 percent and 23.99 percent, which is derived on the basis of a user’s credit score. Apple aims to make the Apple Card popular through widespread usage, thus the wide APR range. The tools built into the Wallet app encourage users to pay off their balances in a streamlined fashion to avoid interest fees.

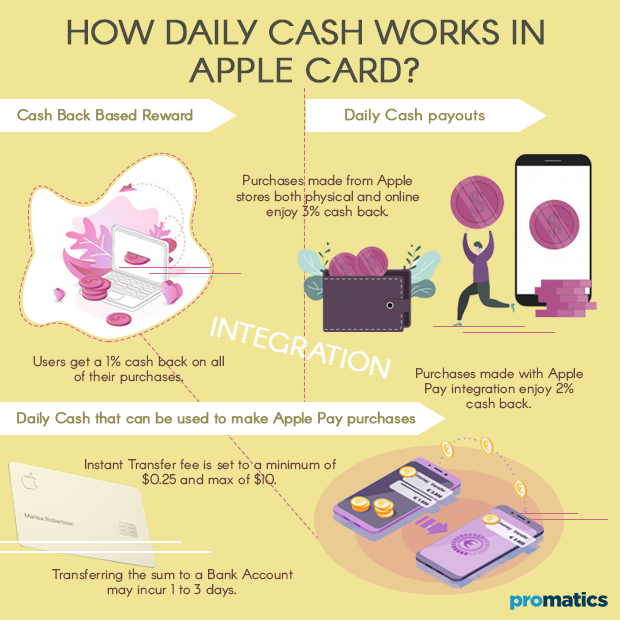

Card Reward and Daily Cash

Apple Card users enjoy the benefits of a cash back based reward system i.e. daily cash upto 3%. Users get a 1% cash back on all of their purchases. Purchases made with Apple Pay integration enjoy 2% cash back. Moreover, purchases made from Apple stores both physical and online enjoy 3% cash back. These purchases include the ones made from the App Store, iTunes Store, and Apple services. Users also reap the benefits of three percent back when they use the Apple Card with Apple Pay for Uber and Uber Eats purchases.

Another lucrative thing about the Apple cash backs is that you d o not have to wait for weeks before they reflect in you digital wallets. Apple pays out a user’s cashback bonuses on a daily basis. Just sign up for Apple Cash. Apple cash adds an Apple Pay Cash debit card to your Wallet that allows you to send and receive money from friends. You can then enjoy Daily Cash payouts on your Apple Cash card. If you out of using the Apple Cash feature you will enjoy the cashback on a monthly basis as a credit on your statement balance. Apple has not limited the amount of Daily Cash that a user can earn.

The Daily Cash that a user earns can be used to make Apple Pay purchases, transferred to friends and family or even to a bank account without any additional cost. However, transferring the sum to a bank account may incur 1 to 3 days. If a user wishes to transfer the money instantly, that can be done with the Instant Transfer feature. This incurs one percent of the total money being sent to the bank account. The Instant Transfer fee is set to a minimum of $0.25 and max of $10. Such money transfers can be made through the Wallet app for the iPhone after a bank account has been linked to Apple Cash.

Even if a user returns a purchase that he or she made with Apple Card, they will be refunded the purchase price back. The Daily Cash that they received on making the purchase is charged back on the Apple Card.

Purchase Notifications

Whenever a user makes any purchase with the Apple Card, they get an instant notification right on their phone. Apple also provides built-in tools for flagging a fraudulent purchase.

PIN for International Purchases

Unlike most other credit cards in the market, the Wallet app does not provide a PIN which is necessary when making credit card purchases outside of the United States. There is absolutely no PIN support. Thus, Apple Card is unlikely to be accepted by certain international vendors.

Payments

When you use Apple Card to make payments, you can see multiple payment options along with the amount of interest that a user would be required to pay on different payment amounts, in real time. Apple aims to encourage users to pay a little extra every month so that they cut down on the interest amount they end up paying, The card also offers vivid flexibility to schedule payments in multiple formats like weekly, biweekly, and monthly rather than just monthly. Users can also make a one-time payment, if they intend to.

Privacy

When a credit or debit card is added to the Wallet App, Apple creates a unique card number on iPhone for it that is stored in the Secure Element. Same is done in case of Apple Card. All payments done through Apple card are confirmed with Face ID or Touch ID along with a one-time unique dynamic security code. This unique security code system ensures that Apple interface does not recognizes which stores a customer shops at or how much he or she pays.